Stronger M&A strategies through AI-driven processes

Globally, organizations spent USD 4.1 trillion on mergers and acquisitions (M&A) in 2018. A significant chunk of capital changed hands: 44 deals were each worth over USD 10 billion.

The electronics industry is no stranger to M&A. Recent examples include Hitachi’s acquisition of ABB’s Power Grids business to create economies of scale. Apple purchased Intel’s mobile modem business to increase control of its supply chain. And Siemens purchased Mendix to accelerate research and development for low code environments. Large acquisitions reshape the marketplace, and powerhouse deals indicate the industry’s fundamental shifts and transformations.

M&A deals are complex, time-consuming, and inherently risky. It takes electronics companies an average of 52 weeks to execute the M&A process from strategy to integration. On average, they achieve about 58 percent of projected synergies, taking an additional 56 weeks to do so. Our respondents report taking 100 weeks post integration to realize a profit.

Using analytics and AI to advance the M&A process

It’s mission critical for buyers and sellers to know if their organizations can blend successfully. Until two organizations move beyond “dating” to merging, “mismatches” are a risk. How can organizations quantify and avoid them?

As we embarked on the 2019 Cross-Industry M&A Benchmark Study, we knew that organizations were examining how advanced analytics and AI could answer these questions—and improve overall M&A performance.

Less clear were:

- What dimensions of the M&A functions (either on their own or as part of the larger corporate development structure) differentiate organizations and performance?

- To what extent are companies applying advanced analytics and AI throughout the M&A lifecycle, and how are they applying them?

- To what extent have analytics and AI improved M&A performance?

Time kills deals, says the old adage. But what makes some deals—and more importantly some organizations—successful?

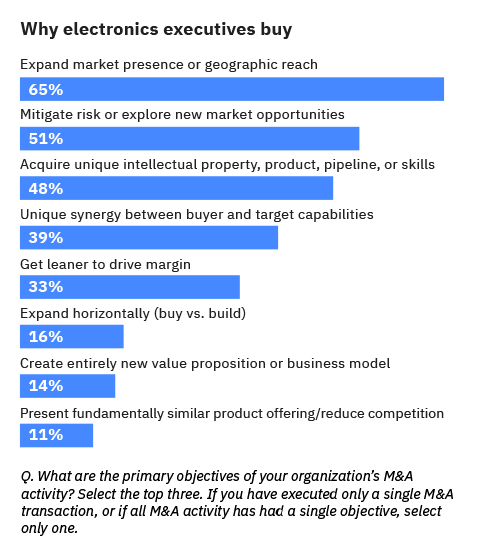

Electronics companies buy for the same reasons as organizations in other industries: to expand market presence or geographic reach (see figure). But beyond those basics, most companies have a more nuanced and layered set of buying criteria. In fact, responses yield more than 70 unique combinations.

Ten tenets for modern M&A

This report shows how the ten M&A tenets can help you integrate automation, analytics, and AI into your M&A processes. (Hint: Begin with the end in mind.) The desired outcome is a set of M&A capabilities that are repeatable and scalable.

This approach to M&A is not simply about better strategy or better integration approaches. Organizations need both. We found:

1. M&A governance and execution approaches, in conjunction with workflow and organizational processes, drive corporate development models for modern M&A.

2. Automation, analytics, and AI are critical to scoping and scaling the process. They help to repeat prior successes, reduce friction, and elevate a company’s portfolio above any one transaction.

3. Not all AI-enabled processes are equal. If you’re in the early stages of infusing intelligence into your processes, some areas contribute more to overall success and synergy than others.

Meet the authors

Cristene Gonzalez-Wertz, Global Electronics, Environment, Energy, and Utilities Research Leader, IBM Institute for Business ValueLisa-Giane Fisher, Leader, Middle East and Africa, and Global Benchmark Research leader, Utilities industry, IBM Institute for Business Value

Christophe Begue

Paul Price, Director, IBM M&A Integration and Corporate Development

Bruce Anderson, Global Managing Director, IBM electronics industry

Download report translations

Originally published 03 January 2020