The end of communications services as we know them

We are likely on the cusp of an historic digital expansion. When economic conditions allow it, some of the most anticipated and world-changing use cases will go mainstream—immersive entertainment, augmented reality (AR), connected vehicles, Industry 4.0, the spatial web, and more. In this report, we will delve into how those economic conditions are likely to emerge and how CSPs can prepare to make necessary cultural, operational, and technological changes to thrive in the new economy.

More often, meeting user expectations will require the integration of connectivity and computing closer to where data resides and decisions are made. The expansion of related physical infrastructure, network functions, and software is expected to be so great that by mid- decade it will usher in an entirely new technological era to reduce cost to a level that makes mass adoption and hyper-expansion feasible.

“Network cloud” will follow in the tradition of personal computers and cloud computing as digitization’s third wave. This wave will converge network and cloud functions, connectivity and computing, infusing data-driven intelligence and automated decision-making into applications, forming what we call “intelligent connectivity” spread throughout network tiers.

5G-driven growth will propel the portion of the economy driven by digital platforms to greater than 50% of the overall world economy.

We anticipate that platforms already established at scale—including but not limited to those that deploy connectivity—will offer what we define as the “platform economic advantage,” becoming de facto staging points for most hypergrowth that occurs later.

An important part of the platform economic advantage involves “platform control points,” which are environments where developers and ecosystems convene around rules, tools, and conventions defined and (as the name implies) controlled by the platform operator. For example, hyperscale public cloud platforms present end users with catalogs of infrastructure configurations coupled with marketplaces of third-party software. The backends of these platforms support interaction between third parties, often settling standards debates by making choices on behalf of the collective. These platforms acquire market power by serving as collaboration junctions that frequently compound value while becoming sticky by encapsulating the tools used for deployment, billing, monitoring, support, and more.

CSPs shoulder most of the burden of investing in infrastructure, but most money is being made by using that infrastructure—not building it.

In just three to four years, sustaining growth may require convening ecosystems around one or more control points—meaning if they are to thrive, most CSPs will need to develop new competencies and assert themselves in new roles in value chains. CSPs should seek new ways to make money, beyond metering connectivity and access to data, as these traditional mainstays of CSP business models are likely to commoditize.

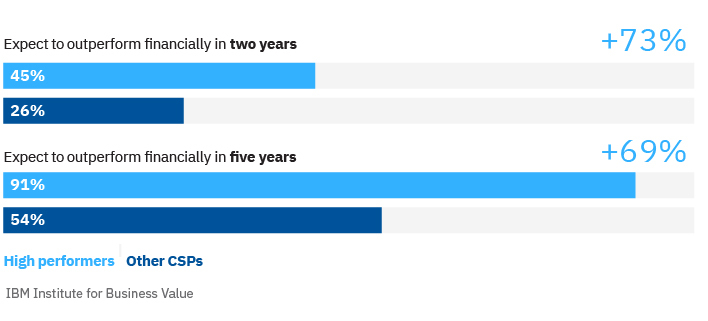

Financial advantage: High performers expect to outperform financially from 5G-enabled edge computing

CSPs have much to offer in the burgeoning 5G-driven platform economy: experience, points of presence, enterprise systems, unique data, and customer trust. Our recent survey on 5G and 5G-enabled edge computing reveals a subset of high performing CSPs that offer insights into how to leverage strengths and develop the cloud native competencies needed to succeed in the rapidly approaching era of network cloud. It is not surprising that more than other CSPs, these high performers seem to value the strategic importance of digital platforms, automation, emerging partner ecosystems, and hybrid cloud.

The future of 5G-enabled edge computing

To better understand the challenges that global CSPs face, the IBM Institute for Business Value (IBV) and Oxford Economics surveyed 500 global telecom executives in 21 countries.

Our survey identified a group of high performers, consisting of 14% of total respondents. These executives self-reported that their organizations outperformed peers in revenue, profitability, and innovation each of the past three years. These organizations also tell us they plan to leverage 5G and5G-enabled edge computing for continued success: 91% expect to outperform financially from the technologies in 5 years versus 54% of their peers.

In addition, 232% more high performers claim they have the capabilities and resources to implement 5G network services, compared to other CSPs. And 137% more high performers say they have the skills needed to implement the technology at scale.

Read the full report to learn more about how 5G-enabled edge computing is transforming the telecommunications industry and how CSPs can gain a competitive advantage.

Meet the authors

Chad Andrews, Global Telecom, Media & Entertainment (TM&E) Leader, IBM Institute for Business ValueSteve Canepa, Global Industry Managing Director, IBM Communications Sector

Bob Fox, US Telecommunications Industry Leader, IBM Consulting

Marisa Viveros, Vice President, Strategy and Offerings, TM&E Industry

Download report translations

Originally published 07 June 2021