Banking on open hybrid multicloud

Today’s banking industry is in a state of flux. In addition to a challenging macroeconomic environment, banks face ever-evolving customer behaviors and expectations in an increasingly digital world.

New types of competitors are catering to those expectations through innovative business models, reducing friction between industry value chains and spawning innovative ecosystems. At the same time, the continued proliferation of data, heightened compliance requirements, growing security threats, and changing workforce dynamics continue their impact on the financial services landscape.

Cloud-based infrastructure can help banks make rapid adjustments in a volatile environment.

In response, financial organizations have been transforming themselves, building new digital capabilities to compete in an era of platforms. Similar to other organizations experiencing the shift to market platforms, banks face technology challenges associated with infrastructure, applications, processes, data, and customer engagement. However, the banking industry also must contend with some of the most stringent industry security and compliance standards, adding further complexity.

Banking looks to cloud

For many years now, banking leaders have been looking at cloud to meet their infrastructure needs for both business flexibility and the rigors required for security and compliance. According to a 2020 report on cloud usage in the industry, 91 percent of financial institutions are actively using cloud services today or plan to use them in the next six to nine months—double the number four years ago. However, very few mission-critical regulated banking workloads have shifted to a public cloud environment—only an average of 9 percent according to one report, which is lower than the average of other industries.

Traditional banking systems are not particularly flexible, making it expensive to adopt new technologies or deploy new functionality.

The scalability and agility available through a cloud-based infrastructure can better equip an organization to rapidly make adjustments and respond to market changes, such as those associated with the pandemic. Pragmatic leaders are taking this lesson a step further with an open hybrid multicloud approach, embracing multiple interoperable platforms that offer the combined security features and flexibility required. A successful migration to an open hybrid multicloud environment requires examining, through the lens of the banking industry’s unique requirements, which platform is appropriate for each application or service.

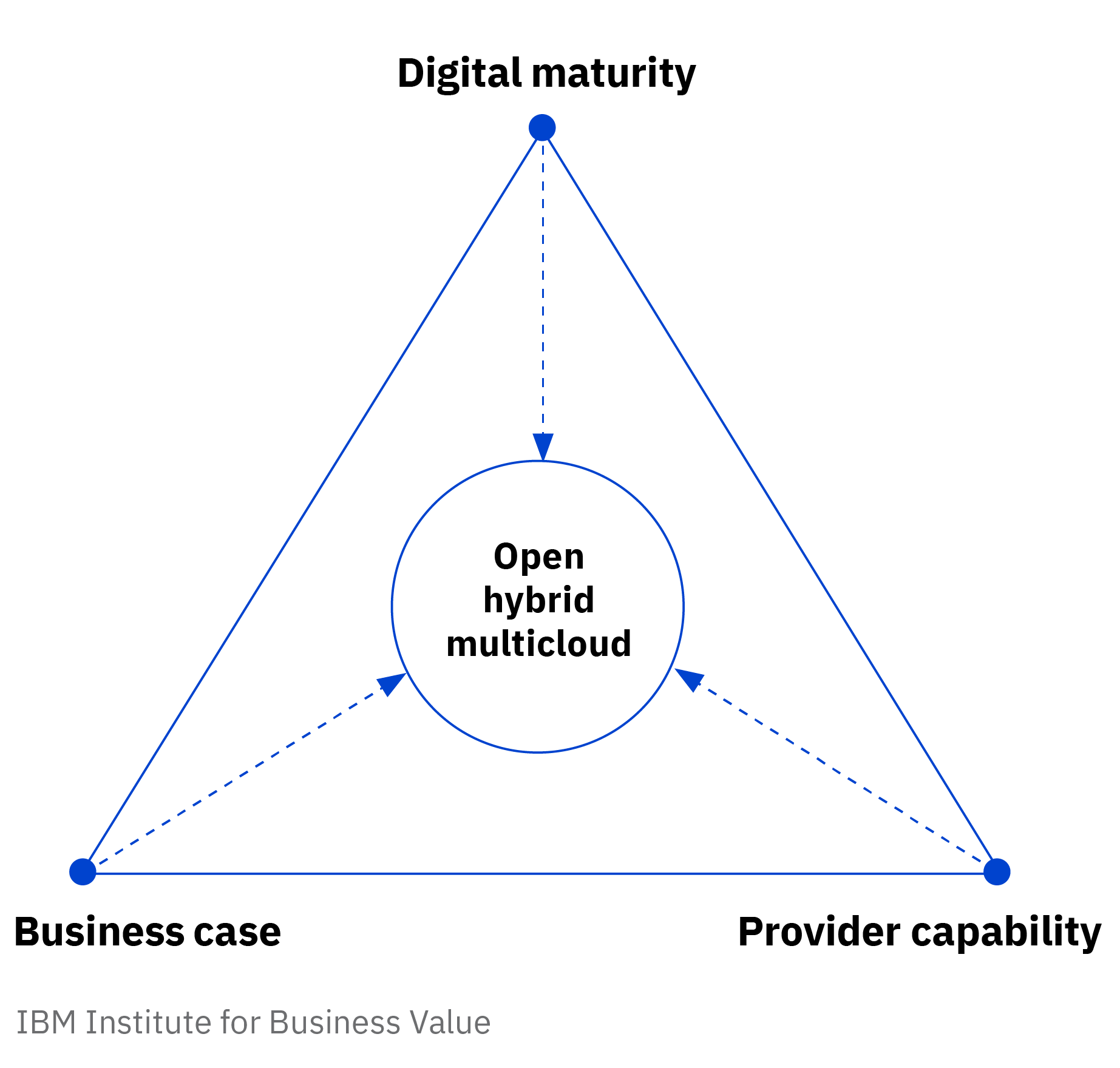

Part of building a successful digital transformation and workload migration strategy involves evaluating three key areas: business case, digital maturity, and provider capability. The business logic behind an open hybrid multicloud approach centers around improving business performance while balancing business needs with IT requirements and cost constraints.

Banks should evaluate three key areas when considering open hybrid multicloud

Read the full report to see how migrating to an open hybrid multicloud environment helps banks balance fintech innovation with security and compliance requirements in a time of transformation.

Meet the author

Anthony Lipp, Global Head of Strategy for Banking and Financial Markets and IBM Industry Academy memberDownload report translations

Originally published 02 December 2020