Traditionally, insurers didn’t need to be overly concerned about how they were perceived by their customers. Whether insurance was mandatory, such as auto or health insurance in many countries, or a basic necessity to secure financial health in case of personal catastrophes, the industry focused more on selling the coverage than providing great customer service afterward.

But times have changed. Due to the proliferation of the internet and social media, customers can easily exchange information about the brands they do business with, their products, and the quality of customer service those brands provide after the deal has closed. Market power has shifted to the consumer. In essence, insurance has moved away from being a product that is sold to one that is bought, and the right CX drives that purchasing decision.

85% of insurers are deploying CX initiatives throughout the customer journey.

Today, customers compare and contrast all manner of service providers, and insurers are increasingly seen through the lens of an informed consumer whose last great experience may have been with an online retailer. Insurers are now being compared against the best CX from other industries—not just other insurers.

Under such heightened scrutiny, how do today’s insurers fare in the minds of consumers? And how do insurers see themselves and their progress in customer experience matters?

Under such heightened scrutiny, how do today’s insurers fare in the minds of consumers?

To better understand the answers to these questions, the IBM Institute for Business Value (IBV) interviewed 1,100 insurance executives in 34 countries regarding their CX initiatives and corresponding key performance indicators (KPIs). We augmented this data with a survey of more than 10,000 consumers across nine countries to hear the customer side of the story. Both surveys were conducted during the COVID-19 pandemic and reflect the specific experiences in these times.

The future of the Insurance customer experience

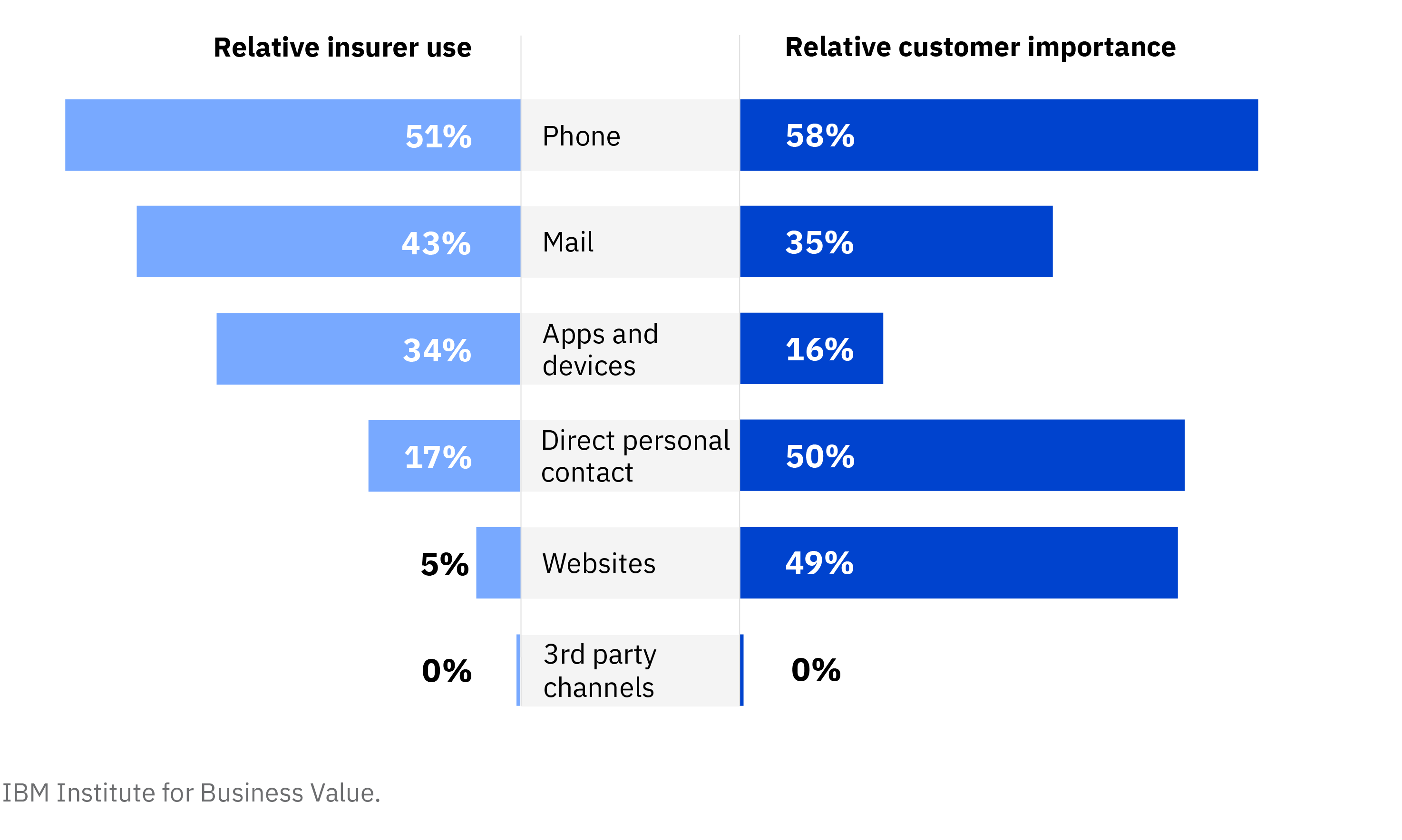

If insurers wish to improve on the CX front, realistic assessments of their capabilities are necessary, and they need to meet customers at their preferred contact points. In their engagement with insurers, consumers highly value contact by phone, in person, or digitally via the web. These channels provide quick interactions and responses, and seamless connections.

Yet, instead of pursuing an omnichannel approach, many insurers continue to engage primarily by phone and traditional mail. The latter is relatively expensive and makes seamless integration difficult, requiring several steps to digitize, analyze, and integrate communications. Investment in digital front office transformation would better align insurers with their customers' engagement needs and improve cost efficiency.

Insurers still rely on old-school communication channels to engage customers

Read the full report to learn how a combination of technology investments and strong emotional connections can help insurers build trust, boost satisfaction, and increase retention with their customers.

Meet the authors

Christian Bieck, Europe Leader & Global Research Leader, Insurance, IBM Institute for Business ValueYoann Michaux, Senior Partner, Enterprise Strategy and Customer Transformation Financial Services Lead, IBM Consulting

Matthew Stremel, Global Insurance Solutions Executive

Download report translations

Originally published 27 October 2020