Insight: Taking a holistic approach with the Honorable Merchant

How to invest now to expedite COVID-19 recovery

At the start of 2020, much of the global business community was on track to become lean, focusing on boosting outputs while diminishing inputs. Using widely deployed production efficiency methods such as Six Sigma and Lean Management, organizations emphasized the cost side of the ledger. In an indication of this trend, Google searches for “save cost” have outstripped those for “increase revenue” over the past fifteen years, often by a factor of more than two.

Many manufacturers had successfully achieved their objective of driving inventory down to as close to zero as possible, deploying just-in-time production and using trucks, roads, rail, and shipping as warehouses. Global trade managed to exploit even slight comparative cost advantages in different parts of the world, enabling a 2018 global goods and commercial services trade volume of more than USD 25 trillion, almost 30 percent of global GDP.

But as we know all too well, this has ground to a halt.

With the extreme disruption of the COVID-19 pandemic, the methods of optimization in many industries profoundly failed. Supermarkets ran out of basic necessities such as toilet paper and soap. Ports were restricted and often closed. Truck and rail traffic was severely curtailed or shut down altogether. And with hundreds of millions of people subject to mandatory lockdowns and stay at home orders, production facilities halted operations.

How is the current situation expected to impact decision making over the next two years?

Supply chains are resilient. Throughput is stable. Events are mostly predictable. These decades-old assumptions were shattered, not marginally but absolutely. Prior events like the Fukushima nuclear meltdown of 2011 had significant supply chain impacts. But those impacts were industry-specific, such as pigments needed in auto manufacturing, not generalized. The world went on with minimal readjustment, confident that such crises were rare and mostly manageable.

This time has been different.

With unprecedented clarity, the COVID-19 pandemic has revealed how precariously intertwined our economic systems and our lives really are. In a mere three months, supply chains across much of the global economy have fractured. Many millions of workers have been furloughed or fully laid off. The travel and hospitality industries have come to a near standstill. Some airlines reduced their international flight schedules by up to 95 percent. Overall, in its “best case” scenario for 2020, the Organization for Economic Co-operation and Development (OECD) projects a global GDP decline of 7.5 percent in 2020. That decline could reach almost 10 percent if a second pandemic wave hits later in the year, which seems highly probable at the time of this writing.

Don’t panic, prioritize

With all this happening around us, how much have longer-term business priorities really changed? In a recent IBM Institute of Business Value (IBV) global survey of 3,450 business leaders, conducted during the full force of the pandemic, we explored which business capabilities executives are prioritizing. What are their immediate reactions in the height of the crisis? How is the current situation expected to impact decision making over the next two years?

The pandemic has thrown organizations into crisis mode, with respondents reporting all business capabilities growing in importance. Asked about the most pressing of those priorities, C-suite executives ranked “workforce safety and security” number one, closely followed by crisis management. But right after that came familiar concerns: cost management and cash flow management.

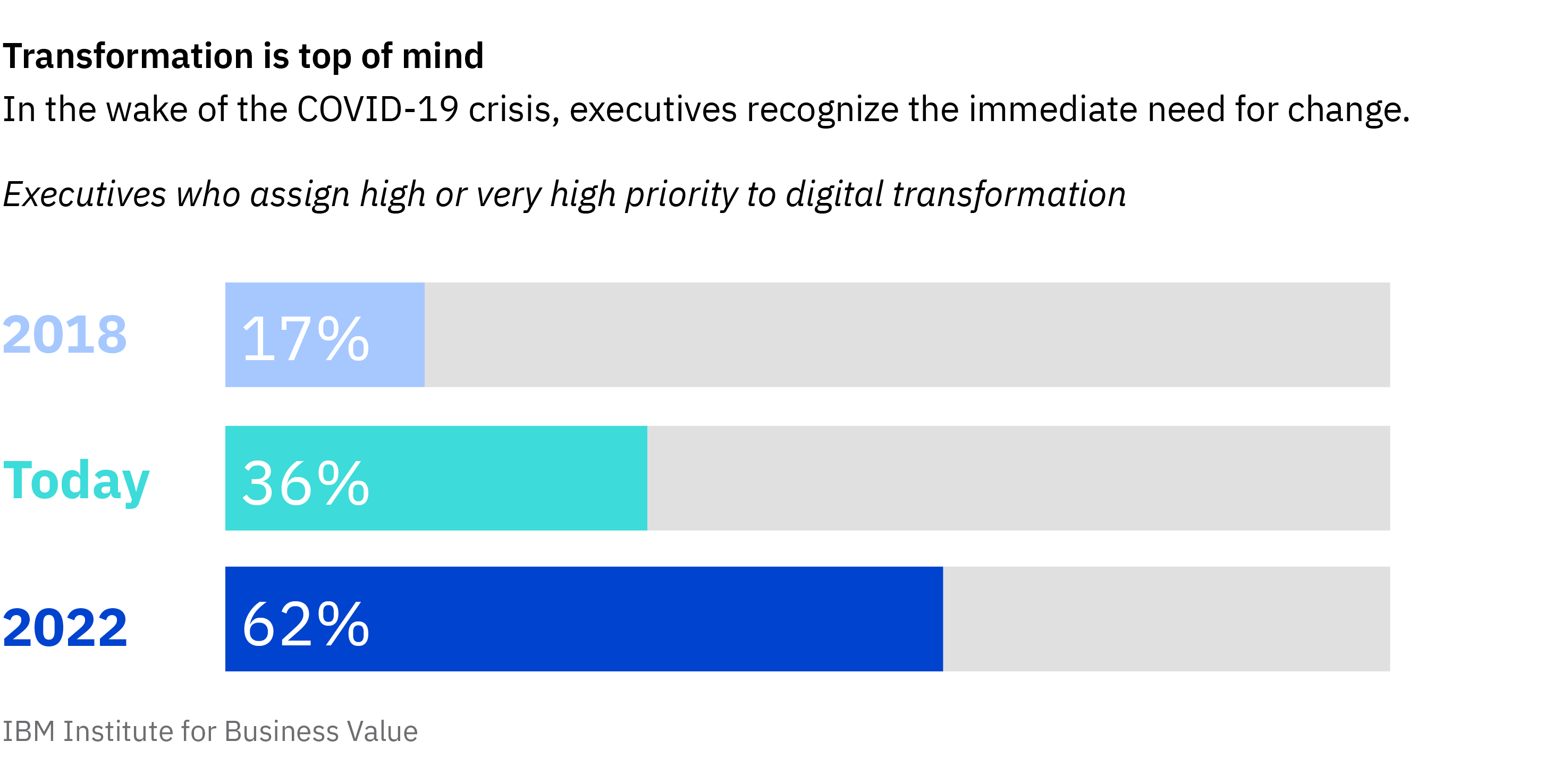

Upon deeper inspection, while cost management clearly remains a top concern, we found that it does not entail traditional cost cutting. While executives worldwide assert the centrality of cost cutting, they also recognize the immediate need to embrace and accelerate digital transformation. Something important is happening that we need to better understand.

Our research has revealed numerous difficulties and challenges in the way organizations are adapting to this different normal. For example, of the executives surveyed, as few as 20 percent of their overall workforce is currently enabled to work remotely. Almost 40 percent of executives say their employees have trouble accessing their organization’s network. Almost half can’t access the necessary technology and tools to do their work effectively while out of a traditional office.

The root cause of these and other constraints is low digital maturity, inadequate digital integration, and poor interoperability. Insight, agility, adaptability, and scalability, all of which underpin rapid and effective adaptation, are constrained. Without these fundamentals, the drivers of rapid response to uncertain events are compromised at best, or absent altogether.

To lease or to buy?

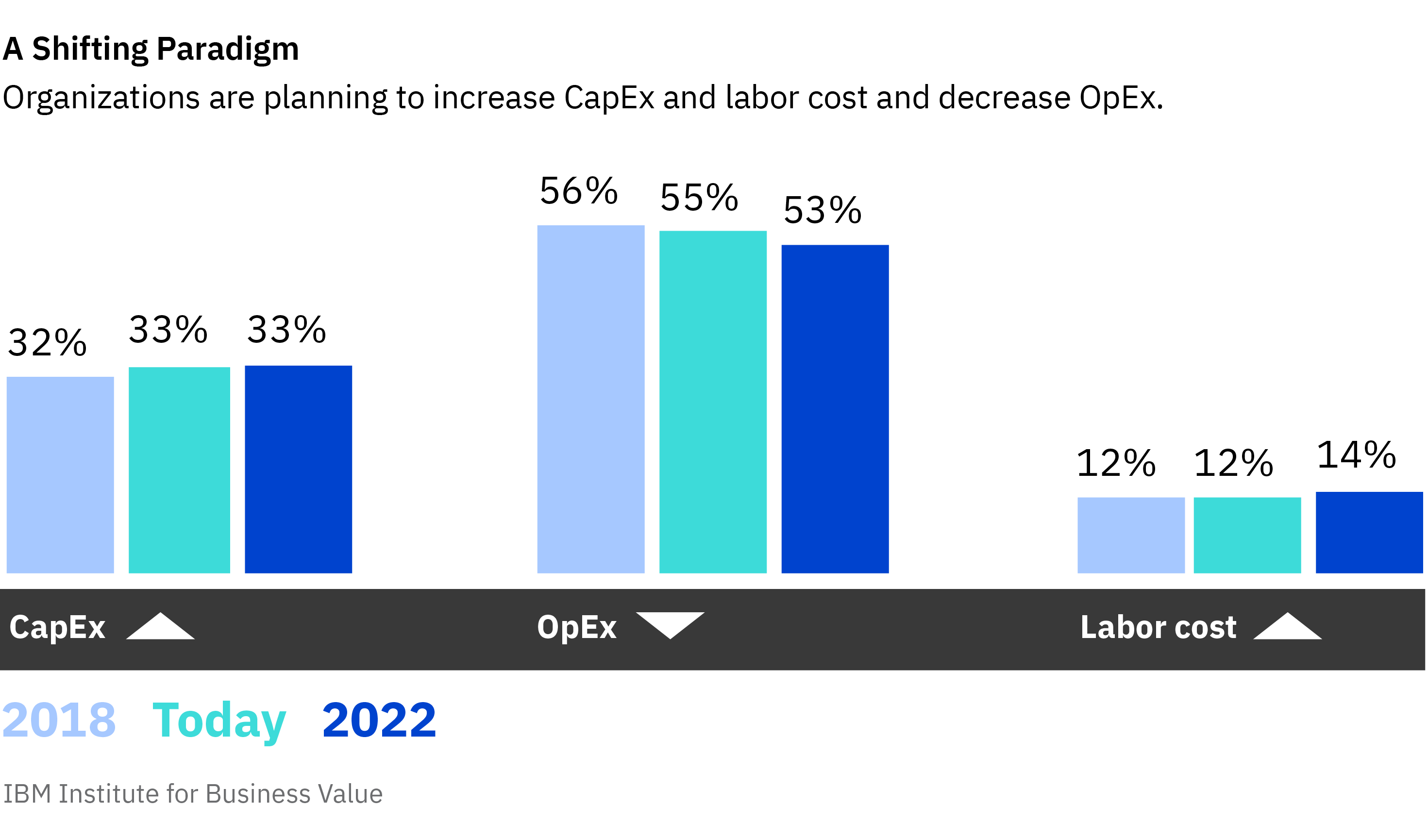

A central theme in the search for cost efficiency is the question of investment and ownership, or capital expenditure (CapEx), versus operating expenditure (OpEx). According to oil magnate J. Paul Getty, “If it appreciates, buy it, if it depreciates, lease it."

Perhaps Getty was prescient: the past decade has seen a steady reduction in the ratio between CapEx to OpEx. For example, in 2005, IT expenditure was 34 percent CapEx versus 66 percent OpEx; by 2019, the relationship had shifted to 24 versus 76 percent.

The reasoning behind this shift is that OpEx increases flexibility for organizations on several fronts. Financially, CapEx requires upfront capital and restricts available cash flow, whereas the regular payment of OpEx does not. But OpEx also has operational advantages over CapEx, in that leased equipment such as computers and machinery are much easier to replace with up-to-date models.

A misspent opportunity

There is little doubt that business agility, which is the ability of an organization to rapidly respond to changes in its environment, is of paramount importance to business success in contemporary markets. Yet the COVID-19 pandemic exposed the flip side of the cost-cutting and expenditure-shifting equation. Most businesses did not take advantage of the flexibility that resulted from those strategies. These organizations were and still are dramatically underprepared for crises of this magnitude.

Shifting CapEx to OpEx might free up funds—but that is only useful if organizations pursue other strategies with these assets, such as digitizing operations and sales.

For example, shifting CapEx to OpEx might free up funds, but that is only useful if organizations pursue other strategies with these assets, such as digitizing operations and sales. All too often, digital transformation gets a strategic nod of the head but little follow through. This is a critical point that many organizations miss.

Invest the right way: CapEx with a technology twist

In the current landscape, business executives continue to focus on cost management. When asked about their priority plans for various business competencies, 87 percent of respondents stated they planned to prioritize cost management to a significant or very great extent. But improving margins only makes sense if it does not hinder flexibility.

In the course of the crisis, executives have come to realize an aspect of ownership that has been underappreciated for a long time: it increases independence and buffers against outside shocks. Consequently, in a reversal of the OpEx shift paradigm, executives state they plan to increase CapEx and decrease OpEx.

Our data shows that executives are right to pursue this approach. We assessed respondents against a series of business capabilities such as business agility, IT resiliency, and workforce empowerment. Our analysis shows that organizations with a high agility score invest almost one percentage point more in CapEx. Also, an increase in CapEx has a small but statistically significant effect on revenue growth.

Where do these increasing capital expenditures go? Partly toward facilities, such as owned plants, properties, and equipment. But as executives have realized that digitization efforts so far have fallen short, they are planning to step up technology investment in all major areas. Organizations plan to increase technology investments from 2018 to 2022 by more than a third, from 4.7 percent of revenue to 6.3 percent. Again, these investment increases have a small but significant effect on growth.

Among other factors, these increased investments in technology may reflect the urgent need to facilitate ongoing remote work. Despite the fact that only 20 percent of the overall workforce was immediately equipped to work remotely, upwards of 80 percent in a recent IBV survey say they now want to continue working outside the office, at least sometimes. Yet executives expect fewer than 25 percent of their workforce to be able to work remotely over the next two years, mainly due to technological limitations.

Executives expect fewer than 25 percent of their workforce to be able to work remotely over the next two years, mainly due to technological limitations.

Cloud is at the top of their priority list. It is a highly flexible and scalable technology that has worked well in the crisis for many organizations that have used it.

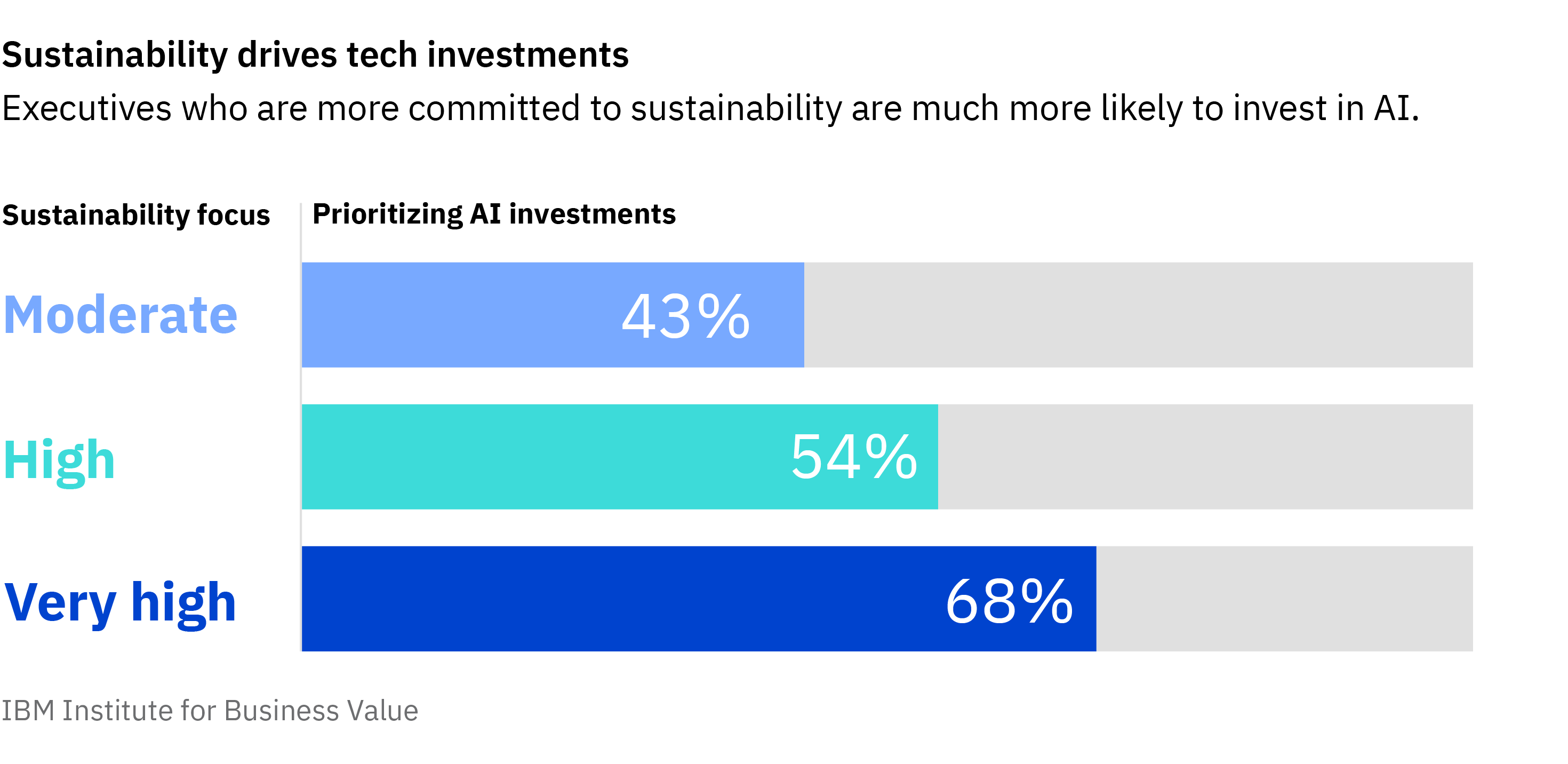

But our data shows that artificial intelligence (AI) could see the greatest leap in investments. Fourteen percent of respondents reported highly prioritizing AI in 2018, yet more than four times as many (57 percent) say that they plan to prioritize AI in 2022. Even before COVID-19, leading organizations saw the potential of “smart” technologies. In a recent IBV survey of more than 2,000 CEOs, leading organizations reported being up to three times more likely than their peers to invest in technologies such as AI and machine learning. And they are far more confident about the potential returns on these investments.

In particular, executives expect AI to help with the sustainability efforts they need for a successful pandemic recovery. And as a result, those that have a stronger focus on sustainability as a business competency are much more apt to invest in AI.

Governments, in particular, increasingly seem to view recovery with environmental strings attached. For example, Germany’s post-COVID-19 recovery aid program allocates EUR 41 billion of the total EUR 130 billion to green initiatives such as public transport, electric vehicles, and renewable energy. Companies that want to participate in state aid must also “go green.” In his speech on June 14, 2020, French president Emmanuel Macron announced similar measures to push French manufacturers and consumers toward ecologically sustainable products.

A majority of executives say their customers favor environmentally and socially conscious products and services, and buy more of them locally. The former has been reinforced by the protests against racial inequality and demonstrations for social reform. While initially a US phenomenon, this movement has spread around the world, shaping the way organizations, their brands, and their goods and services are perceived and consumed.

The principle of the Honorable Merchant is a historically rooted model of operating a business in Europe. The principle prizes prudent accounting and operating, taking responsibility toward the enterprise and all its stakeholders including society and environment. Our survey data shows that the ideals of the Honorable Merchant are returning to executive thinking: an unexpected positive outcome of this crisis.

Tips to help forward-looking executives invest in recovery and growth

Re-affirm digital transformation. If there is anything that recent events have taught us, it’s that enterprise transformation is never complete. Organizations that thought they had finalized or had substantially progressed through their digital transformation quickly realized they were wrong. An ongoing transformation, evolution, or reinvention is key to enabling organizations to navigate the inevitable next shock.

Place transformation at the center of strategy. Digital enterprise transformation should include improvements to all aspects of digital maturity and integration, from processes to functions to engagement. Focus on investments that improve enterprise-wide interoperability. Even very recently, many businesses were not prioritizing the ability to shift seamlessly between business operations and functions. This needs to change.

Re-think organization as organism. The current economic environment has shattered long-held, entrenched assumptions, helping the most successful companies identify and eradicate organizational weaknesses. Clearly, cost cutting is essential in times of economic stress, but not in the traditional sense. We cannot save our way to survival this time. Cost cutting should be viewed as a mechanism to redirect resources to enterprise transformation investments.

Diverting savings to dividends or share buybacks is tempting. But right now savings need to be funneled to transformational technologies and other investments that promote flexibility and ultimately help re-grow the business. Transformation should include instrumentation and responsiveness through the application of AI on the cloud. This can align systems and processes to sense abrupt changes and respond autonomically, just as people react to threats without thinking about them. The algorithms of response can be embedded in the system, eliminating the need for traditionally slow decision making.

Re-embed change as a fundamental cultural principle. Recent months have been a shock to everyone—from the most junior frontline staff to the CEO. It has become patently clear that organizations need to model their leadership and culture on the ability to change. For example, a finance organization that wants to cut costs and not invest in transformation does not effectively serve an environment in which transformation is a mandate. Similarly, other functions, such as marketing and development, should participate in some level of cost cutting to contribute to overall enterprise transformation goals. This type of strategic alignment is a hallmark of successful transformation.

A “flexibility as necessity” vision needs to come from the top. The maxim “do what you say and say what you do” has never been more important. Support your team in ways large and small as you all navigate myriad uncertainties and progress toward a re-envisioned, jointly shared tomorrow.

Meet the authors

Christian Bieck, Europe Leader & Global Research Leader, Insurance, IBM Institute for Business ValueAnthony Marshall, Senior Research Director, Thought Leadership, IBM Institute for Business Value

Download report translations

Originally published 03 July 2020